利用机器学习赚钱

你有1000美元可以挥霍。你决定投资股市,特别是特斯拉。

让我们看看能否利用机器学习来优化我们的回报。

从这里下载 TSLA.csv:https://www.kaggle.com/timoboz/tesla-stock-data-from-2010-to-2020/data

让我们开始吧。

让我们首先对我们得到的文件进行一些探索性数据分析(EDA)。

该文件是一个包含 7 列的逗号分隔值 (CSV) 文件。

这些列是:

- 日期

- 开盘价

- 当日最高价

- 当日最低价

- 收盘价

- 调整收盘价,考虑拆分等因素

- 交易量

# Importing pandas. "pandas is a fast, powerful, flexible and easy to use open source data

# analysis and manipulation tool, built on top of the Python programming language."

import pandas as pd

pd.options.display.max_rows = 30

# Read in the CSV, save it to a pandas dataframe variable called 'tsla_data'.

tsla_data = pd.read_csv("TSLA.csv");

# .head() gives us the first 5 rows of the data frame.

# You can also pass .head() a parameter to return any number of rows. Like .head(10) for 10 rows.

tsla_data.head()

| 日期 | 打开 | 高的 | 低的 | 关闭 | 调整收盘价 | 体积 | |

|---|---|---|---|---|---|---|---|

| 0 | 2010年6月29日 | 19.000000 | 25.00 | 17.540001 | 23.889999 | 23.889999 | 18766300 |

| 1 | 2010年6月30日 | 25.790001 | 30.42 | 23.299999 | 23.830000 | 23.830000 | 17187100 |

| 2 | 2010年7月1日 | 25.000000 | 25.92 | 20.270000 | 21.959999 | 21.959999 | 8218800 |

| 3 | 2010年7月2日 | 23.000000 | 23.10 | 18.709999 | 19.200001 | 19.200001 | 5139800 |

| 4 | 2010年7月6日 | 20.000000 | 20.00 | 15.830000 | 16.110001 | 16.110001 | 6866900 |

# .shape tells us the number of rows, and the number of columns.

# This dataset has 2416 rows, and 7 columns.

# The NYSE and NASDAQ average about 253 trading days a year.

# This is from 365.25 (days on average per year) * 5/7 (proportion work days per week)

# - 6 (weekday holidays) - 3*5/7 (fixed date holidays) = 252.75 ≈ 253.

# 10 * 253 = 2530, this dataset is pretty close. Let's assume it's not missing any days.

tsla_data.shape

(2416, 7)

这是 10 年的数据,其中包含从 2010 年开始的股票信息。

为了节省时间,让我们做一些假设,我们还不是对冲基金经理。

假设

- 我们每天只能下达一个订单(买入或卖出),订单金额为持有的全部金额。

- 如果我们下订单,我们假设它会以该价格成交。

- 我们从 1000 美元开始

我们将追踪一些关键信息。

- 钱包里的钱

- 持有股票数量

让我们从 2010 年开始,看看如果我们在这个文件的第一天以 1000 美元开始,我们会赚多少钱。

# We're going to just pull the 2010 data. I like sticking this in variable, and array,

# because we'll likely do this again, and by multiple years.

years_to_pull = [2010]

# Let's tell pandas to treat the 'Date' column as a date.

tsla_data['Date'] = pd.to_datetime(tsla_data['Date'])

# Let's make a function for re-use

def pull_data_by_year(tsla_data, years_to_pull):

tsla_data_by_year = tsla_data[tsla_data['Date'].dt.year.isin(years_to_pull)]

return tsla_data_by_year

tsla_data_by_year = pull_data_by_year(tsla_data, years_to_pull)

tsla_data_by_year.shape

(130, 7)

# Sort by date ASC

tsla_data_by_year = tsla_data_by_year.sort_values(by = 'Date')

我们来添加几列来帮助我们处理数据。我想查看明天的调整后收盘价,并知道它是否高于今天的调整后收盘价。

# .shift(-1) brings the next row into the equation, so that we can add a column that

# shows tomorrow's adjusted close.

tsla_data_by_year["Adj Close Tomorrow"] = tsla_data_by_year["Adj Close"].shift(-1)

# This adds another column as a bool to quickly show if the stock goes up or down tomorrow.

tsla_data_by_year["Stock Goes Up Tomorrow"] = tsla_data_by_year["Adj Close"] < tsla_data_by_year["Adj Close Tomorrow"]

# Let's look at the first 10 rows to see if this looks correct.

tsla_data_by_year.head(10)

| 日期 | 打开 | 高的 | 低的 | 关闭 | 调整收盘价 | 体积 | 明天收盘价 | 明天股票上涨 | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | 2010年6月29日 | 19.000000 | 25.000000 | 17.540001 | 23.889999 | 23.889999 | 18766300 | 23.830000 | 错误的 |

| 1 | 2010年6月30日 | 25.790001 | 30.420000 | 23.299999 | 23.830000 | 23.830000 | 17187100 | 21.959999 | 错误的 |

| 2 | 2010年7月1日 | 25.000000 | 25.920000 | 20.270000 | 21.959999 | 21.959999 | 8218800 | 19.200001 | 错误的 |

| 3 | 2010年7月2日 | 23.000000 | 23.100000 | 18.709999 | 19.200001 | 19.200001 | 5139800 | 16.110001 | 错误的 |

| 4 | 2010年7月6日 | 20.000000 | 20.000000 | 15.830000 | 16.110001 | 16.110001 | 6866900 | 15.800000 | 错误的 |

| 5 | 2010年7月7日 | 16.400000 | 16.629999 | 14.980000 | 15.800000 | 15.800000 | 6921700 | 17.459999 | 真的 |

| 6 | 2010年7月8日 | 16.139999 | 17.520000 | 15.570000 | 17.459999 | 17.459999 | 7711400 | 17.400000 | 错误的 |

| 7 | 2010年7月9日 | 17.580000 | 17.900000 | 16.549999 | 17.400000 | 17.400000 | 4050600 | 17.049999 | 错误的 |

| 8 | 2010年7月12日 | 17.950001 | 18.070000 | 17.000000 | 17.049999 | 17.049999 | 2202500 | 18.139999 | 真的 |

| 9 | 2010年7月13日 | 17.389999 | 18.639999 | 16.900000 | 18.139999 | 18.139999 | 2680100 | 19.840000 | 真的 |

按照低买高卖的规则,我们通过查看历史数据,可以得出以下结论。

首先选择第二天收盘价上涨的第一天,并在当天购买价值 1000 美元的股票。

我们将有 3 个职位。

买入

卖出

持有

在代码中:

haveNoStock && !goesUpTomorrow = 持有

没有库存 && 明天上涨 = 买入

有库存 && !明天上涨 = 卖出

haveStock && goUpTomorrow = 持有

# Setting some default values of the new columns.

# Position can be Hold/Sell/Buy

tsla_data_by_year['Position'] = 'Hold'

tsla_data_by_year['Number Of Stocks Held'] = 0

tsla_data_by_year['Money In Wallet'] = 0

# .at says at row 0, column 'Money in Wallet', save $1000

tsla_data_by_year.at[0, 'Money In Wallet'] = 1000

tsla_data_by_year.head()

| 日期 | 打开 | 高的 | 低的 | 关闭 | 调整收盘价 | 体积 | 明天收盘价 | 明天股票上涨 | 位置 | 持有股票数量 | 钱包里的钱 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2010年6月29日 | 19.000000 | 25.00 | 17.540001 | 23.889999 | 23.889999 | 18766300 | 23.830000 | 错误的 | 抓住 | 0 | 1000 |

| 1 | 2010年6月30日 | 25.790001 | 30.42 | 23.299999 | 23.830000 | 23.830000 | 17187100 | 21.959999 | 错误的 | 抓住 | 0 | 0 |

| 2 | 2010年7月1日 | 25.000000 | 25.92 | 20.270000 | 21.959999 | 21.959999 | 8218800 | 19.200001 | 错误的 | 抓住 | 0 | 0 |

| 3 | 2010年7月2日 | 23.000000 | 23.10 | 18.709999 | 19.200001 | 19.200001 | 5139800 | 16.110001 | 错误的 | 抓住 | 0 | 0 |

| 4 | 2010年7月6日 | 20.000000 | 20.00 | 15.830000 | 16.110001 | 16.110001 | 6866900 | 15.800000 | 错误的 | 抓住 | 0 | 0 |

# Here's my code for determining if I should buy/sell/hold.

# We'll put this in a function down the line.

previousRow = ''

for index, row in tsla_data_by_year.iterrows():

if(index > 0):

row['Money In Wallet'] = previousRow['Money In Wallet']

row['Number Of Stocks Held'] = previousRow['Number Of Stocks Held']

if(row['Number Of Stocks Held'] == 0 and not row['Stock Goes Up Tomorrow']):

row['Position'] = 'Hold'

# print(1)

elif(row['Number Of Stocks Held'] == 0 and row['Stock Goes Up Tomorrow']):

row['Position'] = 'Buy'

row['Number Of Stocks Held'] = row['Money In Wallet'] / row['Adj Close']

row['Money In Wallet'] -= row['Number Of Stocks Held'] * row['Adj Close']

# print(2)

elif(row['Number Of Stocks Held'] > 0 and not row['Stock Goes Up Tomorrow']):

row['Position'] = 'Sell'

row['Money In Wallet'] += row['Number Of Stocks Held'] * row['Adj Close']

row['Number Of Stocks Held'] = 0

# print(3)

elif(row['Number Of Stocks Held'] > 0 and row['Stock Goes Up Tomorrow']):

row['Position'] = 'Hold'

# print(4)

previousRow = row

tsla_data_by_year.at[index] = row

# Round each number to 2 decimal places.

tsla_data_by_year = tsla_data_by_year.round(2)

# Let's look at the last row to see how much money or stock we have at the end of the year.

tsla_data_by_year.tail(1)

| 日期 | 打开 | 高的 | 低的 | 关闭 | 调整收盘价 | 体积 | 明天收盘价 | 明天股票上涨 | 位置 | 持有股票数量 | 钱包里的钱 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 129 | 2010年12月31日 | 26.57 | 27.25 | 26.5 | 26.63 | 26.63 | 1417900 | 钠 | 错误的 | 卖 | 0.0 | 8645.73 |

如果我们预知未来的话,截至 2010 年底,我们将拥有 8,645 美元。

现在让我们用机器学习来解决这个问题。关键在于记住,这是一门科学,这是一个实验。我们需要遵循科学方法。

我们的假设:我们将尝试预测股票明天是上涨还是下跌。

当我们试图预测两种可能的结果时,这被称为二元分类。

我们的目标是,对于给定的一行,我们可以预测该股票明天是否会上涨的列,但我们掌握的只有今天的最高/最低价和价格。这并不能提供太多信息,我们需要尝试分析历史价格的趋势。为此,我们使用技术指标。

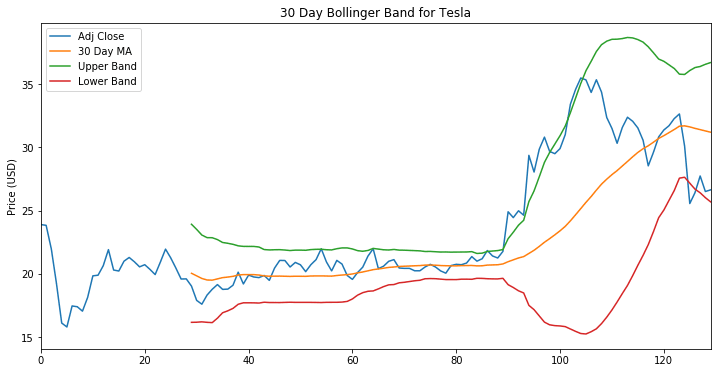

## Add bollinger bands

## To learn more about bollinger bands: https://www.investopedia.com/terms/b/bollingerbands.asp

import matplotlib.pyplot as plt

tsla_data_by_year['30 Day MA'] = tsla_data_by_year['Adj Close'].rolling(window=30).mean()

tsla_data_by_year['30 Day STD'] = tsla_data_by_year['Adj Close'].rolling(window=30).std()

tsla_data_by_year['Upper Band'] = tsla_data_by_year['30 Day MA'] + (tsla_data_by_year['30 Day STD'] * 2)

tsla_data_by_year['Lower Band'] = tsla_data_by_year['30 Day MA'] - (tsla_data_by_year['30 Day STD'] * 2)

# Simple 30 Day Bollinger Band for Tesla

tsla_data_by_year[['Adj Close', '30 Day MA', 'Upper Band', 'Lower Band']].plot(figsize=(12,6))

plt.title('30 Day Bollinger Band for Tesla')

plt.ylabel('Price (USD)')

plt.show();

# This plot will show us the adjusted close, the rolling average, and the upper

# and lower bands of the TSLA stock.

# Since we used a 30 day moving average, the starting 30 days do not have

# bollinger bands information.

# We use dropna() to drop the nulls.

tsla_data_by_year = tsla_data_by_year.dropna()

tsla_data_by_year.head()

| 日期 | 打开 | 高的 | 低的 | 关闭 | 调整收盘价 | 体积 | 明天收盘价 | 明天股票上涨 | 位置 | 持有股票数量 | 钱包里的钱 | 30天移动平均线 | 30天性病 | 上带 | 下带 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 二十九 | 2010年8月10日 | 19.65 | 19.65 | 18.82 | 19.03 | 19.03 | 1281300 | 17.90 | 错误的 | 抓住 | 0.00 | 1660.38 | 20.041333 | 1.937226 | 23.915786 | 16.166880 |

| 三十 | 2010年8月11日 | 18.69 | 18.88 | 17.85 | 17.90 | 17.90 | 797600 | 17.60 | 错误的 | 抓住 | 0.00 | 1660.38 | 19.841667 | 1.832744 | 23.507156 | 16.176178 |

| 31 | 2010年8月12日 | 17.80 | 17.90 | 17.39 | 17.60 | 17.60 | 691000 | 18.32 | 真的 | 买 | 94.34 | 0.00 | 19.634000 | 1.714383 | 23.062765 | 16.205235 |

| 三十二 | 2010年8月13日 | 18.18 | 18.45 | 17.66 | 18.32 | 18.32 | 634000 | 18.78 | 真的 | 抓住 | 94.34 | 0.00 | 19.512667 | 1.672380 | 22.857427 | 16.167907 |

| 33 | 2010年8月16日 | 18.45 | 18.80 | 18.26 | 18.78 | 18.78 | 485800 | 19.15 | 真的 | 抓住 | 94.34 | 0.00 | 19.498667 | 1.676840 | 22.852346 | 16.144987 |

# Some fantastical python.

from sklearn.model_selection import train_test_split

from sklearn.preprocessing import LabelEncoder

import sklearn.model_selection

import sklearn.datasets

import sklearn.metrics

import numpy as np

from matplotlib import pyplot, dates

# Here we are saying we want to predict the column 'Stock Goes Up Tomorrow' by

# storing the column name in a variable.

predict = 'Stock Goes Up Tomorrow'

X = tsla_data_by_year

# Treat the date as a number

X['Date'] = X['Date'].dt.strftime('%Y%m%d')

# For each column, apply a LabelEncoder. Regression problems need numerical values

# or categorical values.

# With columns like 'Position', we need to apply a LabelEncoding

# to set 1 = Hold, 2 = Buy, 3 = Sell

# (this is an example, the LabelEncoder will determine

# the numerical values of the categories at runtime.)

for column in X.columns:

if column != 'Date':

if X[column].dtype == type(object):

le = LabelEncoder()

X[column] = le.fit_transform(X[column])

# Set the y dataset to just the single column we want to predict.

y = tsla_data_by_year[predict]

# Set the X dataset (what we will use to predict), to all the columns mentioned.

X = tsla_data_by_year[['Date', 'Open', 'High', 'Low', 'Close', 'Adj Close', 'Volume', '30 Day MA', '30 Day STD', 'Upper Band', 'Lower Band']]

# This is used to stratify. Learn more here: https://en.wikipedia.org/wiki/Stratified_sampling

targets = tsla_data_by_year[predict]

# This splits the dataset into training and testing. 60% of the data will be

# used to train, 40% will be used to test.

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.40, random_state=101, stratify=targets)

X_test.head()

| 日期 | 打开 | 高的 | 低的 | 关闭 | 调整收盘价 | 体积 | 30天移动平均线 | 30天性病 | 上带 | 下带 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 65 | 20100930 | 22.00 | 22.15 | 20.19 | 20.41 | 20.41 | 2195800 | 20.382333 | 0.786847 | 21.956028 | 18.808639 |

| 106 | 20101129 | 35.41 | 35.95 | 33.33 | 34.33 | 34.33 | 1145600 | 26.106333 | 5.340324 | 36.786982 | 15.425684 |

| 57 | 2010年9月20日 | 20.67 | 21.35 | 20.16 | 21.06 | 21.06 | 947500 | 19.866667 | 1.058318 | 21.983302 | 17.750031 |

| 99 | 20101117 | 30.20 | 30.75 | 28.61 | 29.49 | 29.49 | 750000 | 23.079667 | 3.586195 | 30.252057 | 15.907276 |

| 90 | 2010年11月04日 | 22.60 | 25.33 | 22.15 | 24.90 | 24.90 | 1874000 | 20.957667 | 0.907603 | 22.772872 | 19.142461 |

from sklearn import ensemble

# hyper parameters for the GradientBoostingRegressor algorithm.. More on this much later.

params = {'n_estimators': 100, 'max_depth': 7, 'min_samples_split': 3,

'learning_rate': 0.01, 'loss': 'ls'}

clf = ensemble.GradientBoostingRegressor(**params)

# Fit the classifier with the training data.

clf.fit(X_train, y_train)

# Use the trained model to predict the testing dataset.

y_pred_original = clf.predict(X_test)

from sklearn.metrics import (confusion_matrix, precision_score, recall_score, f1_score, classification_report)

y_pred = y_pred_original > .5

y_pred = pd.DataFrame(y_pred)

y_pred = y_pred * 1

print(confusion_matrix(y_test, y_pred))

print(classification_report(y_test, y_pred))

# The confusion matrix will show us True/False Positives, True/False Negatives.

# This dataset is really small to get an accurate reading of the score,

# but so far it looks like we're close to 50% accurate.

[[12 7]

[14 7]]

precision recall f1-score support

False 0.46 0.63 0.53 19

True 0.50 0.33 0.40 21

accuracy 0.48 40

macro avg 0.48 0.48 0.47 40

weighted avg 0.48 0.47 0.46 40

我们比抛硬币还差一点!让我们看看这是怎么回事。

predictions = clf.predict(X)

# The values of predictions are stored as a value from 0.00 to 1.00, but we need them

# as a true/false to work with our algorithm to calculate $$. Here I compare to .5 (threshold)

# to determine if the prediction is true or false.

# You can manually adjust the threshold to get a better True Positive / True Negative rate,

# sometimes it's beneficial if they're trying to reduce a particular metric.

predictions = predictions > .5

X['Stock Goes Up Tomorrow'] = predictions

# Same code as above, functionized. Use a dataset to determine

# how much money we'll have made with our trades.

def howMuchMoneyDidWeMake(X):

if('Money In Wallet' not in X ):

X['Position'] = 'Hold'

X['Number Of Stocks Held'] = 0

X['Money In Wallet'] = 0

X.at[0, 'Money In Wallet'] = 1000

previousRow = ''

for index, row in X.iterrows():

# print(row)

if(index > 0):

row['Money In Wallet'] = previousRow['Money In Wallet']

row['Number Of Stocks Held'] = previousRow['Number Of Stocks Held']

if(row['Number Of Stocks Held'] == 0 and not row['Stock Goes Up Tomorrow']):

row['Position'] = 'Hold'

# print(1)

elif(row['Number Of Stocks Held'] == 0 and row['Stock Goes Up Tomorrow']):

row['Position'] = 'Buy'

row['Number Of Stocks Held'] = row['Money In Wallet'] / row['Adj Close']

row['Money In Wallet'] -= row['Number Of Stocks Held'] * row['Adj Close']

# print(2)

elif(row['Number Of Stocks Held'] > 0 and not row['Stock Goes Up Tomorrow']):

row['Position'] = 'Sell'

row['Money In Wallet'] += row['Number Of Stocks Held'] * row['Adj Close']

row['Number Of Stocks Held'] = 0

# print(3)

elif(row['Number Of Stocks Held'] > 0 and row['Stock Goes Up Tomorrow']):

row['Position'] = 'Hold'

# print(4)

previousRow = row

X.at[index] = row

X = X.round(2)

return X

X = X.reset_index()

X = howMuchMoneyDidWeMake(X)

X.tail(1)

| 指数 | 日期 | 打开 | 高的 | 低的 | 关闭 | 调整收盘价 | 体积 | 30天移动平均线 | 30天性病 | 上带 | 下带 | 明天股票上涨 | 位置 | 持有股票数量 | 钱包里的钱 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 99 | 128 | 2010年12月30日 | 27.7 | 27.9 | 26.38 | 26.5 | 26.5 | 2041100 | 31.28 | 2.63 | 36.55 | 26.02 | 错误的 | 抓住 | 0.0 | 2917.96 |

还不错!我们的钱几乎翻了三倍。最后我们得到了2917美元。

但这里有一个新手常犯的错误。我们用训练算法时用的数据来衡量成功。我们需要另一个数据集来测试。等到明年再试一次吧。

# Let's pull 2011 data.

years_to_pull = [2011]

tsla_data_by_year = pull_data_by_year(tsla_data, years_to_pull)

def addBollingerBands(df):

df['30 Day MA'] = df['Adj Close'].rolling(window=30).mean()

df['30 Day STD'] = df['Adj Close'].rolling(window=30).std()

df['Upper Band'] = df['30 Day MA'] + (df['30 Day STD'] * 2)

df['Lower Band'] = df['30 Day MA'] - (df['30 Day STD'] * 2)

df = df.dropna()

return df

tsla_data_by_year = addBollingerBands(tsla_data_by_year)

tsla_data_by_year.head()

| 日期 | 打开 | 高的 | 低的 | 关闭 | 调整收盘价 | 体积 | 30天移动平均线 | 30天性病 | 上带 | 下带 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 159 | 2011年2月14日 | 23.639999 | 24.139999 | 23.049999 | 23.08 | 23.08 | 1283100 | 24.937333 | 1.720240 | 28.377814 | 21.496853 |

| 160 | 2011年2月15日 | 23.010000 | 23.170000 | 22.559999 | 22.84 | 22.84 | 953700 | 24.811333 | 1.731142 | 28.273617 | 21.349049 |

| 161 | 2011年2月16日 | 23.100000 | 24.969999 | 23.070000 | 24.73 | 24.73 | 4115100 | 24.746667 | 1.695178 | 28.137023 | 21.356310 |

| 162 | 2011年2月17日 | 24.629999 | 25.490000 | 23.549999 | 23.60 | 23.60 | 2618400 | 24.639000 | 1.660516 | 27.960031 | 21.317969 |

| 163 | 2011年2月18日 | 23.330000 | 23.490000 | 22.959999 | 23.18 | 23.18 | 2370700 | 24.482333 | 1.563047 | 27.608427 | 21.356240 |

# Function to add the predicted column to a dataset using a trained classifier

def addPredictedColumn(df, clf):

df['Date'] = df['Date'].dt.strftime('%Y%m%d')

# df["Adj Close Tomorrow"] = df["Adj Close"].shift(-1)

df = df.dropna()

for column in df.columns:

if column != 'Date':

if df[column].dtype == type(object):

le = LabelEncoder()

df[column] = le.fit_transform(df[column])

predictions = clf.predict(df)

predictions = predictions > .5

df['Stock Goes Up Tomorrow'] = predictions

return df

tsla_data_by_year = addPredictedColumn(tsla_data_by_year, clf)

tsla_data_by_year = tsla_data_by_year.reset_index()

tsla_data_by_year = howMuchMoneyDidWeMake(tsla_data_by_year)

tsla_data_by_year.tail(1)

| 指数 | 日期 | 打开 | 高的 | 低的 | 关闭 | 调整收盘价 | 体积 | 30天移动平均线 | 30天性病 | 上带 | 下带 | 明天股票上涨 | 位置 | 持有股票数量 | 钱包里的钱 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 222 | 381 | 2011年12月30日 | 28.49 | 28.98 | 28.25 | 28.56 | 28.56 | 339800 | 30.66 | 2.33 | 35.33 | 25.99 | 错误的 | 抓住 | 0.0 | 1652.3 |

如果我们用 2010 年训练的模型来预测 2011 年的数据,最终结果会是 1652.01 美元。这很糟糕。我认为问题在于我们没有考虑 2011 年 TSLA 的新数据,我们只是用 2010 年的数据来预测 2011 年的数据。这根本行不通。

如果我们在 2011 年每 30 天重新训练一次模型会怎么样?这样,分类器每 30 天就会根据发现的任何新模式进行“重置”。

existing_df = tsla_data_by_year

years_to_pull = [2011]

tsla_data_by_year = pull_data_by_year(tsla_data, years_to_pull)

tsla_data_by_year = addBollingerBands(tsla_data_by_year)

tsla_data_by_year = tsla_data_by_year.reset_index()

working_df = tsla_data_by_year[:30]

working_df = working_df.drop(columns=['index'])

working_df = addPredictedColumn(working_df, clf)

working_df = howMuchMoneyDidWeMake(working_df)

all_the_money = pd.concat([working_df], sort=True)

for i in range(1, 8):

new_first_row = working_df[-1:]

for column in working_df.columns:

if column != 'Date':

if working_df[column].dtype == type(object):

le = LabelEncoder()

working_df[column] = le.fit_transform(working_df[column])

existing_df = pd.concat([existing_df, working_df], sort=True)

working_df = tsla_data_by_year[30*i:30*i+30]

existing_df["Adj Close Tomorrow"] = existing_df["Adj Close"].shift(-1)

existing_df = existing_df.dropna()

existing_df["Stock Goes Up Tomorrow"] = existing_df["Adj Close"] < existing_df["Adj Close Tomorrow"]

predict = 'Stock Goes Up Tomorrow'

X = existing_df

for column in X.columns:

if column != 'Date':

if X[column].dtype == type(object):

le = LabelEncoder()

X[column] = le.fit_transform(X[column])

y = existing_df[predict]

X = existing_df[['Date', 'Open', 'High', 'Low', 'Close', 'Adj Close', 'Volume',

'30 Day MA', '30 Day STD', 'Upper Band', 'Lower Band']]

targets = existing_df[predict]

params = {'n_estimators': 100, 'max_depth': 7, 'min_samples_split': 3,

'learning_rate': 0.01, 'loss': 'ls'}

clf = ensemble.GradientBoostingRegressor(**params)

clf.fit(X, y)

working_df = working_df.drop(columns=['index'])

working_df = addPredictedColumn(working_df, clf)

working_df = pd.concat([new_first_row, working_df], sort=True)

working_df = working_df.reset_index(drop=True)

working_df = howMuchMoneyDidWeMake(working_df)

all_the_money = pd.concat([all_the_money, working_df], sort=True)

all_the_money.tail(1)

| 30天移动平均线 | 30天性病 | 调整收盘价 | 关闭 | 日期 | 高的 | 低的 | 下带 | 钱包里的钱 | 持有股票数量 | 打开 | 位置 | 明天股票上涨 | 上带 | 体积 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 十三 | 30.66 | 2.33 | 28.56 | 28.56 | 2011年12月30日 | 28.98 | 28.25 | 25.99 | 0.0 | 322.57 | 28.49 | 买 | 真的 | 35.33 | 339800 |

2011 年每 30 天重新训练一次模型,最终我们得到 322 股,每股 28.56 美元,总计 9,196 美元。

那太好了!

马上打电话给我的经纪人。

后端开发教程 - Java、Spring Boot 实战 - msg200.com

后端开发教程 - Java、Spring Boot 实战 - msg200.com